Introduction

Cryptocurrencies have revolutionized the financial world, offering a decentralized and secure alternative to traditional banking systems. However, this innovative market is not immune to risks, and one of the most significant dangers is a crypto market crash.

In this article, I will explore the various aspects of cryptocurrency crashes, from historical examples to lessons learned, and strategies to protect your investments.

Please read it, comment it and share!

The Risks of a Crypto Market Crash

Let me first write, that cryptocurrency market is still in very strong bull market, but it won’t last forever! If you are on the investment markets you should already know – to much optimist and euphoria lead to irrational thinking. What’s more, cryptocurrency market is extremally volatile and this asset class is really risky. Just telling you!

As with any investment, there are inherent risks associated with cryptocurrencies. While the market offers tremendous potential for growth and profit, it is crucial to understand the potential downsides.

A crypto market crash refers to a sudden and significant decline in the value of digital assets. Such crashes can occur due to various factors, including regulatory changes, security breaches, or even market speculation.

United States is Back

Happily for us, in United States happen a lot of miracles – “United States is back!”. I don’t want to go into details about politics, but United States were on really bad track.

Last election change a lot! Let me remind you a few things.

First of all, Gary Gensler step down from SEC lead position and this is great news for all crypto enthusiasts and investors. During his chairmanship of the Securities Exchange Commission, cryptocurrencies went through a difficult period.

Many projects were considered securities and the development of the cryptocurrency market was limited. The Bitcoin ETFs themselves had to wait almost 2 years for their approval by the commission. 2 years is a really long time for the cryptocurrency market, which is a very young and innovative market. For this reason, Gary’s departure in January 2025 is a very good sign.

The second factor proving that things were bad in the United States was constantly rising unemployment, inflation and growing debt.

It is true that the United States is still in this state, but Mr. Trump has taken over since January. In the next 4-5 years, this will be the great comeback of the United States, all thanks to Trump’s business approach to the topic. Believe me or not, this guy knows his subject like no other!

The last point I want to mention is the departure from Christian tradition and moral principles. I do not want to lecture anyone here, but ethical behaviour in accordance with moral principles has created our European civilization.

Either way, America is back!

This does not change the fact that there is always a possibility of a crash on the cryptocurrency market. Well, because today this is the topic I am describing.

Read on to learn more about this topic.

Historical Examples of Crypto Market Crashes

To comprehend the risks associated with a crypto market crash, it is essential to examine historical examples.

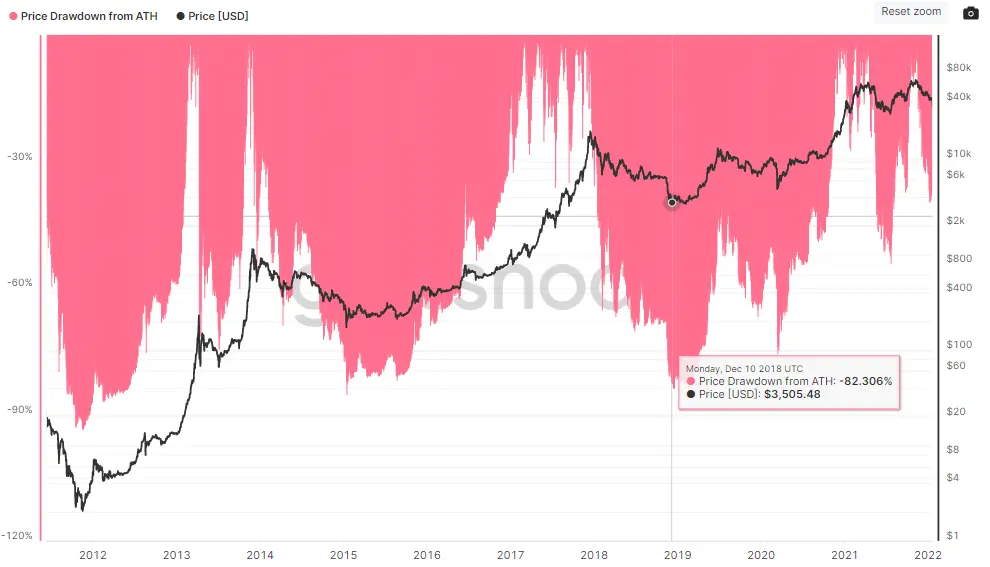

One such notable crash occurred in 2018 when Bitcoin, the leading cryptocurrency, experienced a significant drop in value. This crash, often referred to as the “Crypto Winter,” saw Bitcoin’s value plummet by over 80%.

Another example is the infamous Mt. Gox exchange collapse in 2014, resulting in the loss of approximately 850,000 Bitcoins. These historical crashes serve as reminders that the cryptocurrency market is not immune to volatility. In this case market lost over 80% as well.

What you would say?

80% is a lot, but a the beginnings of cryptocurrencies market lost 99%!!

You read this right. 99% loss in 2011. Maybe nobody remember that time, because it was very early, but still it happen. Market lost 99% as a result of Mt. Gox hack, but it was not the last time when hack on this exchange happen. 2 year later in 2013 exchange were hacked again. Then, market lost 83%!

I you can easily see beginnings were difficult and happen a lot not expected things…

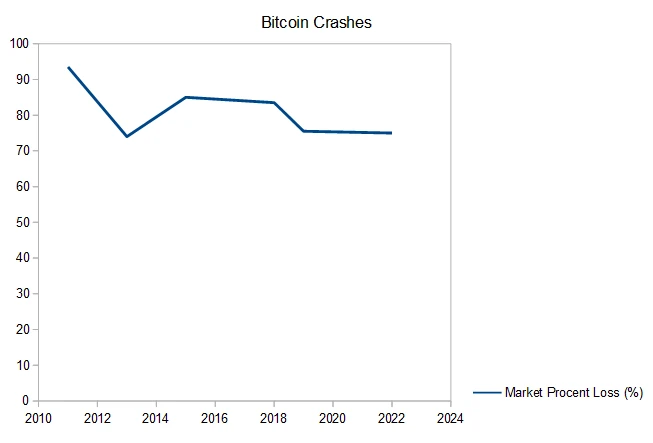

Take a look on graphic below with all smaller and bigger market crashes. I did not mention corrections what happen on cryptocurrency market during bull market quite often.

Obviously, every year market is more mature and as a consequence lost on Bitcoin are smaller. Besides, investors – private and institutional wake up and become more aware about awesomeness of this asset!

One of the first graphics which I have ever used on this blog. Don’t believe me just read this post.

My point is that crashes is part of nature of this market. Every year I would expect less lost on the market, because investors will transfer from short-term to long-term investors. Why would you sell asset what give you at least 21% every year (if you consider 4 year investment or longer). It’s long?

Man, if you know a little about financial market then you are aware that most of the markets don’t give you return more than 10% yearly. Only S&P500 index give you return of investment on this level. The same with most ETFs.

Ok, let’s jump to lessons learned from past crashes.

Lessons Learned from Past Crypto Market Crashes

While crypto market crashes can be devastating, they also provide valuable lessons for investors.

One crucial lesson is the importance of diversification. By spreading investments across different cryptocurrencies and assets, investors can mitigate the impact of a single currency’s crash. This is general approach, but to be honest. With experience and knowledge you can invest in less assets simply because you know their nature.

Additionally, conducting thorough research and staying informed about market trends and regulatory developments can help investors make more informed decisions and potentially avoid significant losses.

The last thing I want to write is that, Bitcoin always come back to price higher than before the crash! This sentence alone should be for you one of the most important lessons on whole cryptocurrency markets.

Identifying Warning Signs of a Potential Crash

Recognizing warning signs can be instrumental in protecting your investments during a crypto market crash.

One primary indicator is a sudden surge in market speculation and irrational exuberance. When the market seems overly optimistic and driven by hype, it may be a sign of an impending crash.

Regulatory changes and negative news surrounding cryptocurrencies can also serve as warning signs. Keeping a close eye on these factors and maintaining a balanced approach to investment can help minimize the impact of a crash.

Again, I come back to actual USA election. We already know that elected president is hodler of cryptocurrencies. The people appointed to his cabinet are also favourable to this market, which should not be surprising!

The cryptocurrency market is a modern market and the move in this direction is a natural move towards technology and innovation.

Protect Your Investments During a Crypto Market Crash

While it is impossible to predict or prevent a crypto market crash entirely, there are strategies investors can employ to protect their investments.

One such strategy is setting stop-loss orders, which automatically sell a specific cryptocurrency if its value drops below a predetermined level. This can help limit potential losses.

Another strategy is diversifying investments across different asset classes, such as stocks, bonds, and commodities. This diversification can provide a cushion during market downturns.

Besides that, it is always the best read the market. Of course, you can be always 100% sure what’s happening, but if a lot of things proving that market is crashing that mean probably market is crashing… Simply, without emotions, analyse and take decision to minimize losses.

Opportunities in a Crypto Market Crash

While a crypto market crash may seem like a time of doom and gloom, it can also present unique opportunities for investors.

During a crash, cryptocurrencies often experience significant price drops, creating buying opportunities for those with a long-term investment perspective. By strategically investing in undervalued assets, investors can potentially reap substantial profits when the market eventually rebounds.

Famous Crypto Losses Stories and Their Impact

Crypto losses stories have become cautionary tales for investors.

One such story is the case of Mark Karpeles and the Mt. Gox exchange collapse. The loss of approximately 850,000 Bitcoins not only affected individual investors but also had a significant impact on the overall perception of cryptocurrencies.

You still can watch what’s happening with wallet during on-chain research.

Of course, after many years partly lost Bitcoins come back to investors. During writing this article you still could found 79957.26703094 BTC ($7,845,902,456.22). Quite nice amount of money. Don’t you think?

These stories highlight the importance of security measures, such as securely storing digital assets and choosing reputable exchanges.

Will be Crypto Market Crash in 2025?

The crypto market crash in a specific year can vary based on various factors and market conditions. For instance, the crash of 2018, often referred to as the “Crypto Winter,” was primarily driven by market speculation and regulatory concerns.

Bitcoin, along with many other cryptocurrencies, experienced a substantial decline in value during this period. Understanding the specifics of each market crash can provide valuable insights into the dynamics and potential risks of the cryptocurrency market.

Bitcoin has cycles and if you strictly watch them in 2025 should happen end of bull market. That, automatically mean market crash will happen in 2025 or 2026 year.

Conclusion

In conclusion, the cryptocurrency market is not immune to risks, and a crypto market crash can have significant implications for investors. However, by understanding the risks, learning from historical examples, and implementing strategies to protect investments, it is possible to navigate the volatile market and even seize opportunities during a crash.

You can learn from another crashes that Bitcoin is come back after every crash. One of strategies you can implement is buying bottom after market crash, but… if you hodl Bitcoin simply much better is stay it in cold wallet and do much more pleasant things.

Leave a Reply

You must be logged in to post a comment.