Introduction

What is all about the Graph cryptocurrency? I am explaining straight that the Graph acts like a search engine for blockchain data, making it easier for developers to build decentralized applications. It’s become a key player in the blockchain ecosystem, and understanding what it is and how it works is crucial for anyone interested in crypto.

In this guide, I’ll walk you through everything you need to know about The Graph.

I’ll look at its history, how it works, and the role of its token, GRT. I’ll also explore The Graph’s partnerships and its place in the broader blockchain world.

By the end, you’ll have a clear picture of why The Graph is so important and how it’s shaping the future of decentralized tech.

Please read it, comment it and of course, share it!

History and Development

The Graph has its roots in the challenges faced by developers in the blockchain space. In 2018, Yaniv Tal, Brandon Ramirez, and Jannis Pohlmann founded The Graph to address the difficulties in creating decentralized applications (dApps) on Ethereum. Their goal was to design and launch the first decentralized indexing and querying app, filling a gap in the market.

Founding team

Yaniv Tal, as the project lead, brought his personal experience of the complexities involved in building dApps on Ethereum. Together with Ramirez and Pohlmann, they formed a team dedicated to simplifying blockchain data access and management.

Key milestones

The Graph’s journey has been marked by significant achievements.

In 2020, they launched the mainnet, a crucial step towards fully decentralizing dApp use. This launch increased the volume of subgraph generation on the network, showcasing the growing demand for The Graph’s services.

Funding rounds

The Graph has secured substantial funding to support its development. In June 2020, they raised $5 million in a token sale, with investors including Framework Ventures, Coinbase Ventures, and Digital Currency Group. Later that year, The Graph conducted a public sale of its native GRT token, raising $12 million.

The project’s potential attracted further investment, with Multicoin Capital contributing $2.5 million. In a significant boost to its ecosystem, The Graph Foundation raised $50 million in January 2022 through a token sale led by Tiger Global Management.

How The Graph Works

The Graph operates as a decentralized indexing protocol for querying blockchain data. It simplifies the process of retrieving specific information from blockchains without direct interaction with complex smart contracts. This is achieved through the creation and maintenance of data indexes, known as subgraphs.

Data indexing process

The indexing process begins with Graph Nodes continuously scanning network blocks and smart contracts for information. When an application adds data to the blockchain through smart contracts, the Graph Node adds this data to its appropriate subgraphs. This process ensures that the most up-to-date information is always available for querying.

Query execution

Once the data has been indexed, it can be easily accessed by applications seeking information to run their software. The Graph provides a GraphQL API that enables developers to query blockchain data using a familiar and expressive syntax. This eliminates the need to write complex code for data retrieval and filtering, making development more efficient.

Fee structure

The Graph’s ecosystem has a token economy model where GRT (the Graph Token) has an influence on rewarding network participants and paying for services in The Graph marketplace. Indexers, who operate nodes in the network, stake GRT to provide indexing and query processing services. They earn query fees and indexing rewards for their services. These fees are collected by gateways and distributed to indexers according to an exponential rebate function. This system ensures that indexers achieve the best outcome by faithfully serving queries.

The Graph’s multi-chain approach allows it to integrate with various blockchains, leveraging their individual strengths. This integration involves adapting The Graph’s indexing and querying capabilities to each blockchain’s specific characteristics, such as transaction speed and smart contract functionalities.

GRT Tokenomics

The Graph’s native token, GRT, has a significant influence on the network’s economy.

Initially, the total supply of GRT was set at 10 billion tokens. However, it’s important to note that this supply isn’t fixed and could potentially increase over time.

Token allocation

The distribution of GRT tokens has an influence on various aspects of The Graph ecosystem. A substantial portion, about 75% of the total supply, has been allocated to insiders, including investors, the team, and The Graph Foundation. This allocation has an impact on the token’s circulation and potential market dynamics.

Inflation and burn mechanisms

The Graph has implemented both inflationary and deflationary mechanisms to manage its token supply. The network has an annual inflation rate of approximately 3%, which has an influence on rewarding network participants such as indexers, delegators, and curators. This inflation adds about 300 million GRT tokens to the supply each year.

To counteract this inflation, The Graph has a burn mechanism in place. Initially, the goal was to burn about 1% of the total supply annually, which would amount to roughly 100 million tokens. However, in practice, the actual burn rate has been significantly lower, with only about half a million tokens burned so far.

Market performance

The market performance of GRT has been influenced by various factors, including its tokenomics. Following its mainnet launch in December 2020, GRT experienced significant price action, at one point reaching levels over 10 times its initial value. However, the aggressive vesting schedule for early investors has had an influence on the token’s market dynamics.

Graph Price in Depth

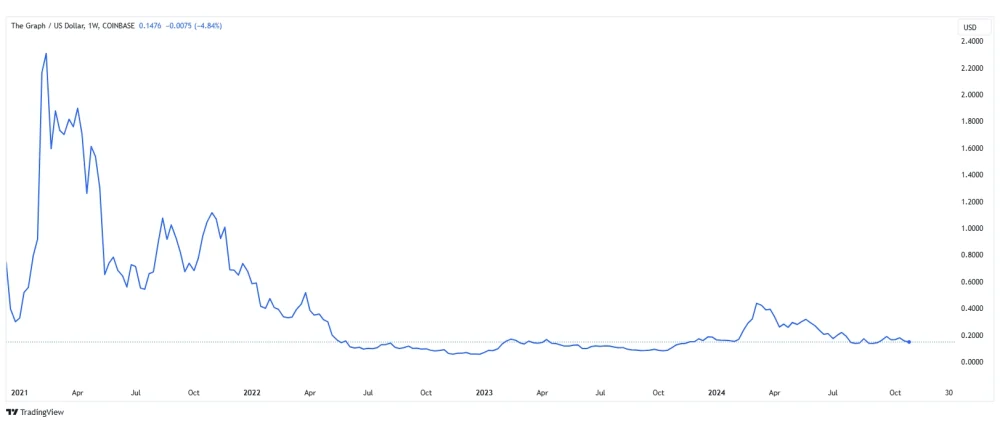

The token has been listed on the exchange for almost 4 years.

One partial bull market and a complete bear market. And the current bull market cycle. There is a lot to analyse, so it’s time to get down to specifics.

1st Bull Market

The price at the beginning of the listing is $0.12 per unit.

Then, within 2 months, the price increased dramatically, up to $2.84 per unit. Which means an increase of 23 times!

A short boom, but what an effect! During the Bitcoin boom, the token entered a bear market.

1st Bear Market

The bear market basically lasted until the end of 2022. Nearly 2 years. Long, and the very bottom of the market is below the starting listing price. 0.05, i.e. All Time Low, was recorded on November 22, 2022. Ten times less than the listing price. The bottom was left undefended. The foundations are still questionable… By the way, the price has dropped by almost 99.5% in 2 years!! Such a drop usually indicates a scam. However, I do not claim that this is what we are dealing with here.

2nd Bull Market

Second bull market. Investors and traders are constantly waiting for a strong bull market.

Without a doubt, this is on the markets, despite the unfavourable economics in the world.

All due to constantly high inflation and high interest rates of players such as the United States, armed conflicts and many other important factors.

Okay, but how does this relate to the project currently being discussed?

The token price in March 2024 jumped to $0.44 per unit. Let me remind you that the bottom was recorded at $0.05 per unit.

The price in the correction bottomed out at $0.13 per unit in August 2024.

Ecosystem and Partnerships

The Graph has established a robust ecosystem and formed strategic partnerships, solidifying its position in the blockchain world. We’ve seen significant growth in our network, supporting a wide range of blockchain platforms and collaborating with notable projects.

Supported networks

The Graph has expanded its reach to include over 40 of the most widely used blockchains.

It now support networks like Ethereum, Arbitrum, Avalanche, Celo, Fantom, Gnosis, Optimism, Polygon, and many more. This multichain expansion has opened up new opportunities for developers across the web3 space. Their recent technical improvements, such as the upgrade Indexer, have made it easier for developers to leverage The Graph’s decentralized network for lower costs and faster syncing times.

Notable projects using The Graph

Many prominent decentralized applications (dApps) have integrated The Graph into their infrastructure. Projects like Vela, Loopring, Snapshot, and Art Blocks are among the thousands of developers building on our supported chains. These dApps benefit from The Graph’s ability to simplify data querying and improve scalability.

The exponential growth in usage has led to over 7 billion queries in a single month, showcasing the increasing reliance on our protocol.

Strategic collaborations

We’ve formed partnerships with key players in the blockchain space to enhance our capabilities and expand our reach. For instance, StreamingFast joined The Graph ecosystem as a core developer team to support protocol research and development and improve indexing performance. This collaboration has an influence on accelerating the adoption of web3 and democratizing data access at scale.

Another significant partnership has been with Arweave, a decentralized data storage protocol. This integration allows The Graph’s subgraphs to efficiently read and organize data stored on Arweave, facilitating quicker access to permanent data storage. These collaborations have an influence on strengthening The Graph’s position as a crucial infrastructure provider in the decentralized ecosystem.

Conclusion

The Graph has made a big impact on how we use blockchain data. It helps developers find and use information more easily. This tool has changed how we build and use decentralized apps. The Graph’s growth and partnerships show how important it is in the blockchain world.

The price of the token increased very dynamically during the bull market, but the current bull market is still uncertain. The project is interesting, but is it enough?

Leave a Reply

You must be logged in to post a comment.