Introduction

The world of cryptocurrency investment is evolving rapidly, and Bitcoin ETFs are at the forefront of this change. These financial products have sparked interest among investors looking to get into the crypto market without directly owning digital assets. Bitcoin ETFs offer a way to gain exposure to Bitcoin’s price movements. By making them an attractive option for both individual and institutional investors.

This guide aims to shed light on them, exploring their benefits and potential risks. I’ll dive into what they are and how they work. Including the difference between Bitcoin spot ETFs and futures-based ETFs.

I’ll also look at the advantages these instruments offer, such as increased liquidity and easier portfolio diversification.

Additionally, I’ll discuss the challenges facing them, from regulatory hurdles to market volatility.

By the end, you’ll have a clearer picture of where they are.

Please read it, comment it and share with the world!

What Are Bitcoin ETFs?

Definition of Bitcoin ETFs

Bitcoin ETFs are investment products that allow investors to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency. These financial instruments combine the familiar structure of exchange-traded funds with the innovative world of digital assets. They are traded on traditional stock exchanges. In general, making them accessible to a wide range of investors through their brokerage accounts.

Types of Bitcoin ETFs

There are two main types of Bitcoin ETFs: spot ETFs and futures-based ETFs.

Spot Bitcoin ETFs directly hold Bitcoin as their underlying asset, providing a straightforward connection to the cryptocurrency’s market value. These funds purchase and store actual Bitcoin in secure digital vaults managed by specialized custodians.

On the other hand, futures-based Bitcoin ETFs invest in Bitcoin futures contracts rather than holding the cryptocurrency itself. These contracts are agreements to buy or sell Bitcoin at a predetermined price on a future date.

How Bitcoin ETFs Work

Spot Bitcoin ETFs operate by purchasing and holding a specific amount of Bitcoin in secure digital wallets. The fund then issues shares that represent ownership in the ETF’s Bitcoin holdings. These shares are priced to reflect the current spot price of Bitcoin. They can be bought and sold on stock exchanges. Just like traditional securities.

The creation and redemption process involves authorized participants. They can exchange large blocks of shares for the equivalent amount of Bitcoin. Overall, helping to keep the ETF’s price aligned with the underlying asset’s value.

Futures-based Bitcoin ETFs, such as the ProShares Bitcoin Strategy ETF, work differently. These funds invest in Bitcoin futures contracts traded on regulated exchanges like the Chicago Mercantile Exchange (CME). The fund managers actively manage the portfolio by rolling over expiring contracts and purchasing new ones for the coming months. This approach aims to track Bitcoin’s price movements without directly holding the cryptocurrency.

Both types of Bitcoin ETFs offer investors a regulated way to gain exposure to the crypto market. Eliminating the need for cryptocurrency wallets or direct interaction with digital asset exchanges.

This structure has made them an attractive option for both individual and institutional investors.

Bitcoin ETFs List

Spot ETFs

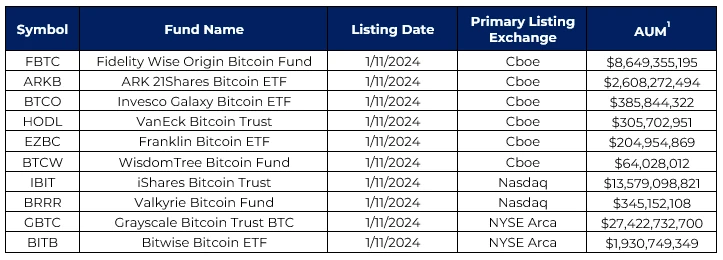

On this point I will not describe all the trackers from the list. I will only concentrate on 5 the biggest ones: FBTC, ARKB, IBIT, GBTC and BITB.

FBTC

Fidelity Wise Origin Bitcoin Fund(FBTC) is very popular fund with tracker FBTC. Nett asset of fund during the writing of article was $11.3B with 1-Year Return 97.45%.

Take a look for FBTC performance.

ARKB

ARKB 21Shares Bitcoin ETF(ARKB) is another well-known fund in cryptocurrency space and not only.

Net assets of fund during the writing of article was $3.21B with 1-Year Return 97.45%.

Take a look for ETF performance.

IBIT

iShares Bitcoin Trust(IBIT) is next one very big fund in the market. Net assets of fund during writing of article was $23.16B with 1-Year Return 97.45%.

Please take a look on fund performance here.

GBTC

Grayscale Bitcoin Trust BTC(GBTC) is one of the most well-know funds in crypto space. If you never heard about this fund then for sure you need to be new in the market. Net assets of fund during writing of article was $14.03B with 1-Year Return 97.45%.

Here you find fund performance site.

BITB

Bitwise Bitcoin ETF(BITB) is one of the biggest Bitcoin funds. Net assets of fund during writing of article was $2.51B with 1-Year Return 97.45%.

Explore freely performance of this fund.

Obviously, the list of spot ETFs has more positions. Unfortunately, I can’t write about all of them.

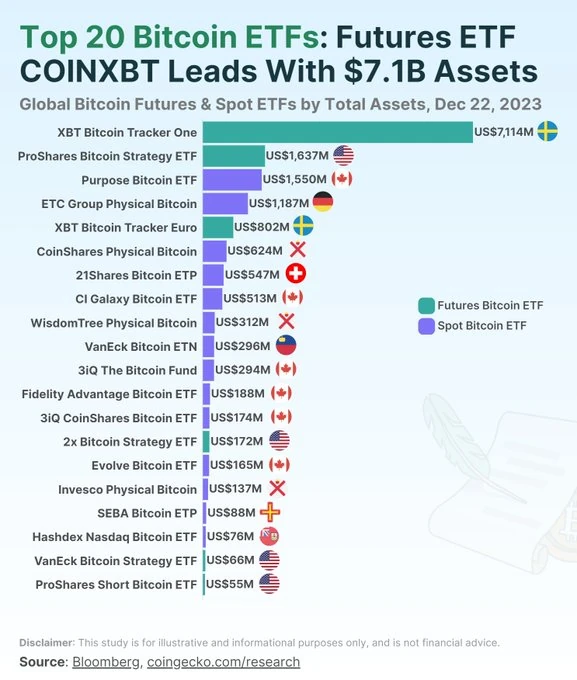

Futures ETFs

In case of future ETFs I am using the same approach and again I am just concentrate on the biggest ETFs in the sector. According to Coingecko research they are XBT Bitcoin Tracker One, ProShares Bitcoin Strategy ETF and XBT Bitcoin Tracker Euro.

XBT Bitcoin Tracker One

One of the oldest futures funds and that way with the longest track history of performance. During the writing article 1-Year Return is equal 129,35%. Pretty impressive.

Explore fund performance here.

ProShares Bitcoin Strategy ETF

Tracker fund(BITO) with 3 years track history and 1-Year Return 115.95%. One of the options to consider without any doubts.

Fund performance you can watch here.

XBT Bitcoin Tracker Euro

Futures fund listed on the Stuttgart Stock Exchange in Germany. It has been on the market since 2017 and its 1-Year Return is 144.70%. Definitely one of the options worth considering!

For more performance information look here.

Sector of ETFs in cryptocurrency space is growing and in this moment we have about 20 of them. In mean in this case spot and futures ETFs. I have explain before what’s the difference between them.

During next 1 or 2 years those ETFs will growing even more dynamically. All of that, because we are still in the bull market and year 2025 definitely will be successful for cryptocurrencies.

Advantages of Bitcoin ETFs

Accessibility for Retail Investors

Bitcoin ETFs have opened up new opportunities for retail investors to gain exposure to the cryptocurrency market.

These investment vehicles allow individuals to add Bitcoin to their portfolios through their existing brokerage accounts. This simplified approach has broadened the investor base.

Then, attracting those who were previously cautious about direct involvement in the crypto market. The familiar structure of ETFs, combined with the ability to trade them on regulated stock exchanges.

Finally, has made Bitcoin investments more approachable for the average investor.

Regulatory Oversight

One of the key advantages of Bitcoin ETFs is the increased regulatory oversight they bring to the cryptocurrency investment landscape. The approval of these funds by regulatory bodies like the Securities and Exchange Commission (SEC) has added a layer of legitimacy to Bitcoin investments.

The SEC has mandated transparent disclosures, requiring ETF sponsors to provide clear and truthful information in public registration statements and periodic filings.

Additionally, these ETFs are subject to exchange oversight, with regulations aimed at preventing fraudulent activities and market manipulation. This regulatory framework offers investors a sense of security and helps to maintain the integrity of the crypto investment market.

Simplified Exposure to Bitcoin

Bitcoin ETFs provide a straightforward way for investors to gain exposure to Bitcoin’s price movements. These funds track the performance of Bitcoin, offering a convenient method to diversify portfolios and potentially benefit from the growth of the cryptocurrency market. For institutional investors, the ETF structure offers a compliant way to include Bitcoin in their portfolios. This simplified exposure has made Bitcoin more accessible to a wider range of investors. It potentially driving demand and pushing the cryptocurrency further into the mainstream financial landscape.

Potential Risks and Challenges

Market Volatility

Bitcoin ETFs are subject to the inherent volatility of the cryptocurrency market. Bitcoin’s price fluctuations are notoriously extreme, with daily average volatility roughly three and a half times that of equities. This high volatility can lead to significant and rapid losses for investors.

During times of market stress, Bitcoin ETFs might exacerbate this volatility, potentially creating unforeseen risks in the broader financial system. The connection between the volatile world of cryptocurrencies and traditional finance through these ETFs could result in spill over effects. Especially if the products become widely adopted.

Tracking Error

A key challenge for Bitcoin ETFs is maintaining accurate tracking of the underlying asset’s performance. Tracking error, which measures the deviation between the fund’s returns and the performance of the Bitcoin index or benchmark, can arise from various factors. The fund’s expense ratio plays a crucial role, as higher fees can impact performance and widen the tracking error.

Additionally, the degree of alignment between the fund’s holdings and the underlying index is vital. Some funds may use a representative sample approach, introducing differences in asset composition that contribute to tracking errors. The liquidity of Bitcoin and its underlying securities can also affect tracking accuracy, particularly if the ETF trades illiquid assets.

Conclusion

Bitcoin ETFs have brought about a revolution in cryptocurrency investing, making it easier to gain exposure to Bitcoin’s price movements. These investment vehicles have an impact on accessibility, regulatory oversight, and simplified exposure to the crypto market.

However, they also come with challenges, including market volatility, tracking errors, and so on.

In summary, the introduction of Bitcoin ETFs marks a significant step in bridging the gap between traditional finance and the world of cryptocurrencies. While they offer new opportunities to investors, it’s crucial to consider both the benefits and risks before diving in.

Leave a Reply

You must be logged in to post a comment.