Introduction

Cryptocurrency enthusiasts and investors are buzzing about CRO token, a digital asset that’s making waves in the blockchain world. What is CRO token, and why is it catching the attention of so many people? This native cryptocurrency of the Cronos blockchain has been gaining traction due to its unique features and potential for growth.

As more investors look to diversify their crypto portfolios, understanding CRO and its ecosystem has become crucial.

In this article, I’ll dive into the essentials of CRO token and explore its role within the Cronos network. I’ll break down the token’s economics, discuss where CRO fits in the broader crypto landscape, and examine the opportunities and risks for investors.

Whether you’re a seasoned crypto trader or just starting out, this guide will give you the lowdown on CRO and help you make informed decisions about this up-and-coming digital asset.

Please read it, comment it and share with the world!

What is CRO Token?

CRO token is the native cryptocurrency of the Cronos blockchain ecosystem.

It plays a crucial role in powering various aspects of the network’s functionality, similar to how ether (ETH) works for Ethereum. CRO has gained significant attention in the crypto world due to its unique features and potential for growth.

Origins and Development

CRO was initially launched in late 2018 as an ERC-20 token on the Ethereum blockchain.

It was created by Crypto.com, a company founded in 2016 by Kris Marszalek, Rafael Melo, Gary Or, and Bobby Bao. The founders aimed to accelerate global adoption of cryptocurrencies and enhance personal control over money.

In November 2021, Crypto.com launched its own standalone blockchain, which was later rebranded as Cronos Chain.

Key Features

Cronos operates as a Layer 1 blockchain within the Cosmos ecosystem. It has several notable features that set it apart:

- Ethereum Compatibility – Cronos supports the Ethereum Virtual Machine (EVM), allowing developers to easily port applications from Ethereum.

- Inter-Blockchain Communication (IBC) – this feature enables seamless transfer of digital assets between different blockchain families.

- Delegated Proof-of-Authority (PoA) Consensus – Cronos uses a PoA mechanism designed for energy efficiency and scalability.

- Governance – CRO token holders have a say in the blockchain’s governance, making it a truly decentralized system.

Utility within Crypto.com Ecosystem

CRO has various use cases within the Crypto.com ecosystem:

- Transaction Fees – users can pay fees on the Cronos network using CRO.

- Staking and Rewards – holders can stake CRO to earn rewards and access benefits like higher cashback and discounts.

- DeFi Access – CRO unlocks decentralized finance features within the ecosystem.

- Store of Value – the token can serve as a store of value, backed by the Crypto.com platform’s success.

The Cronos Blockchain

The Cronos blockchain is a decentralized, open-source platform designed to support the growing demand for decentralized applications (dApps) in various sectors, including DeFi, NFTs, and the metaverse.

Built with the Cosmos SDK and powered by Ethermint, Cronos aims to provide a scalable and interoperable solution for developers and users alike.

Architecture and Consensus Mechanism

Cronos uses a modified version of the Tendermint Proof-of-Stake (PoS) consensus mechanism, which offers faster transaction processing and lower fees compared to traditional Proof-of-Work chains.

This architecture allows Cronos to handle hundreds to thousands of transactions per second with finality in 5-6 seconds, making it more efficient and cost-effective for users.

The blockchain’s unique design combines elements from both Ethereum and Cosmos ecosystems. It supports the Ethereum Virtual Machine (EVM), enabling developers to easily port their Solidity-based smart contracts and dApps from Ethereum to Cronos with minimal modifications.

Interoperability with Other Chains

One of Cronos’ key features is its focus on interoperability.

The blockchain supports the Inter-Blockchain Communication (IBC) protocol, allowing seamless communication and asset transfers between Cronos and other IBC-enabled chains in the Cosmos ecosystem.

This capability expands the utility of Cronos-native assets and enables support for tokens from other compatible networks.

dApps and DeFi Ecosystem

Cronos has fostered a growing ecosystem of decentralized applications and DeFi projects. Some notable dApps include VVS Finance, a simple DeFi platform for token swapping and yield farming, and Tectonic, a lending and borrowing protocol.

The blockchain also supports NFT marketplaces like Minted and Ebisu’s Bay, as well as various other DeFi and GameFi projects.

CRO Token Economics

CRO token, the native cryptocurrency of the Cronos blockchain, has a unique economic structure designed to support the ecosystem’s growth and stability.

Understanding what CRO token is and its economic model is crucial for investors looking to explore the Cronos network.

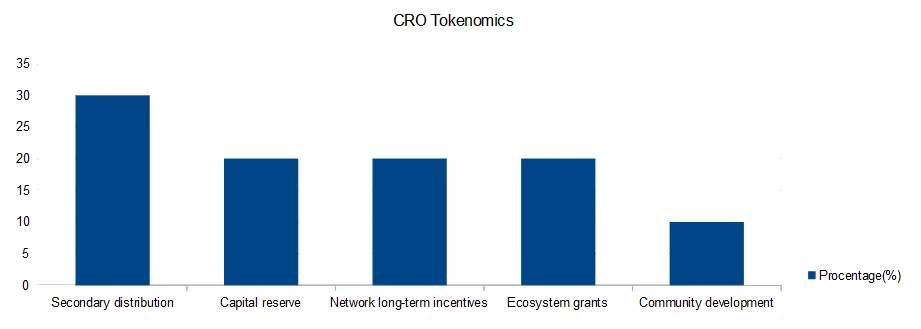

Supply and Distribution

The total supply of CRO is capped at 30 billion tokens, making it a deflationary asset. This limit was established after a significant token burn in 2021, which reduced the initial supply of 100 billion tokens. The remaining supply has been allocated for various purposes:

- Secondary distribution and launch incentives (30%)

- Capital reserve (20%)

- Network long-term incentives (20%)

- Ecosystem grants (20%)

- Community development (10%)

This distribution aims to ensure the network’s long-term sustainability and foster its growth.

Staking and Rewards

Staking plays a vital role in the CRO token ecosystem.

Users can stake their CRO tokens to participate in the network’s security and earn rewards. The Cronos blockchain uses a Delegated Proof-of-Stake (DPoS) consensus mechanism, allowing users to delegate their tokens to trusted validators.

Validators run nodes to process transactions on the Cronos network and receive block rewards in CRO, which are then shared with delegators after deducting a commission. The estimated annual return for staking during the initial launch phase was set as high as 20%, with 500 million CRO allocated for yearly rewards.

Governance Capabilities

CRO token holders have a say in the network’s governance, making Cronos a truly decentralized system. The Cronos community can make governance proposals for changes to blockchain parameters or community spending. To submit a proposal, a minimum amount of CRO must be deposited during a 14-day period.

Voting power is determined by the amount of CRO staked, allowing token holders to influence the network’s future direction. This governance model ensures that the Cronos ecosystem evolves according to the community’s needs and preferences.

CRO Price in Depth

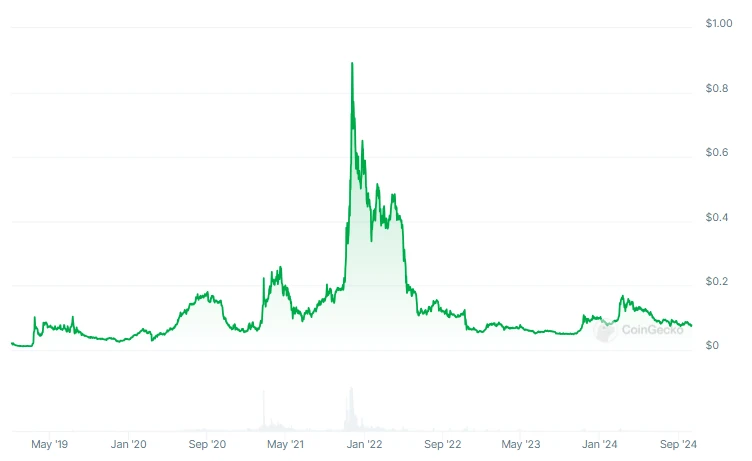

1st Bull Market

The listing price on the exchanges was a really bargain price of $0.02 per token unit.

Over time, CRO turns out to be one of the largest exchanges in the entire cryptocurrency market, but who could have known it then.

As so far, ATH occurred at the end of the bull market in the entire cryptocurrency market.

Of course, the price went through different phases during the uptrend.

What I mean here is corrections and retreats to support levels.

Let me remind you of a few facts. The listing started at the beginning of 2019, and the entire bull market ended in November 2021.

The peak price is $0.96 per unit.

The price has increased by 48 times in almost 3 years! The price grew most dynamically last year when there was euphoria on the market!

1st Bear Market

During the bear market, the price dropped very dynamically.

The decline was the most dynamic in the first half of the year. Price at the beginning of October 2023 to $0.05 per unit.

Capital flowed out of the market very dynamically…

At the end of the bear market, the price stayed above the starting price at the listing. I will also add that the bear market lasted almost 2 years.

All this is due to the FTX scam. This scam had a huge impact on the market and the behaviour of traders/investors.

2nd Bull Market

The token boom basically started about 1 year ago. Then, the price started to rebound.

The current price is $0.075 per unit. Which means that the price has increased by 50% within a year, and a strong boom is still ahead of us!

Investing in CRO

Market Performance

CRO token has shown significant growth potential, reaching an all-time high of $0.97 in November 2021.

However, like many cryptocurrencies, it experiences high volatility, with price fluctuations that can be 10 times higher than traditional markets. This volatility presents both opportunities for substantial gains and risks of significant losses.

Adoption and Partnerships

Crypto.com, the company behind CRO, has been actively expanding its reach through strategic partnerships and regulatory compliance.

The platform has secured registrations in various countries, including the UK, France, and Dubai, potentially increasing CRO’s adoption. The Cronos blockchain’s focus on supporting Web3 applications, DeFi, and GameFi could drive further utility and demand for the token.

Regulatory Considerations

Investing in CRO comes with regulatory risks.

The cryptocurrency space faces increasing scrutiny from regulatory bodies worldwide. While Crypto.com has made efforts to comply with regulations in multiple jurisdictions, changes in regulatory landscapes could impact CRO’s value and utility.

Investors should stay informed about the evolving regulatory environment and its potential effects on what is CRO token and its ecosystem.

When considering where is cro used, it’s important to note that the Cronos blockchain hosts various decentralized applications, contributing to its growing ecosystem.

Understanding what is Cronos and its role in the broader crypto landscape is crucial for assessing the long-term potential of CRO as an investment.

Conclusion

The CRO token and Cronos blockchain present an intriguing opportunity in the ever-changing world of cryptocurrencies. As you’ve seen, CRO has a significant influence on the Cronos ecosystem, powering transactions, enabling staking rewards, and giving users a voice in network governance.

In fact, Cronos has unique features, including Ethereum compatibility and inter-blockchain communication, set it apart in the crowded crypto landscape.

For investors, CRO offers both potential rewards and risks to consider. Its market performance has shown promise, but like all cryptocurrencies, it’s subject to high volatility.

The growing adoption of Cronos for Web3 applications and DeFi projects could drive future demand for CRO.

Leave a Reply

You must be logged in to post a comment.