Introduction

Indeed, are you looking for a more stable way to make gains in the cryptocurrency market? Instead of chasing massive price rallies, consider staking coins (cryptocurrencies).

Staking has gained popularity as an alternative to traditional mining and trading strategies, because offering the opportunity to earn passive income.

In this comprehensive guide, I will explore the top 17 staking coins that can help you maximize your passive income potential, at first.

So, let´s jump into next chapter.

About Staking

In fact, staking is a process that allows cryptocurrency holders to participate in the validation and transaction processing of a blockchain network.

Then by staking their coins, users contribute to the security and stability of the network, and in return, they earn rewards in the form of additional coins.

Proof of Stake and Proof of Work

They are two different consensus algorithms used by blockchain networks – Proof of Stake (PoS) and Proof of Work (PoW), but not only.

Generally speaking, that they are used in 2 main heroes of cryptocurrency market – Bitcoin and Ethereum.

While PoW relies on miners solving complex mathematical problems to validate transactions and create new blocks, PoS selects validators based on the number of coins they hold and are willing to “stake” as collateral.

Indeed, consensus mechanisms are the mechanisms that ensure the security and effectiveness of cryptocurrencies.

A common problem is the trilemma blockchain, in general. The question arises how to design the consensus mechanism so that the blockchain remains secure, remains scalable and remains sufficiently secure.

In fact, Pow and PoS are the mechanisms of the two largest cryptocurrencies. Since they are used in the two largest projects, these mechanisms are the basis of all other mechanisms.

This is not entirely true, but these two projects constitute 67% of the capitalization of the entire market.

To be sure you can read about the consensus mechanism.

How Staking Works

In a PoS blockchain, users lock a certain amount of their coins as a stake in a designated wallet, indeed.

Consequently, the size of the stake determines the user’s chances of being selected as a validator to create new blocks and validate transactions.

Then, validators are rewarded with transaction fees and additional coins for their contribution to the network.

As you can see, staking coins are assets that, when allocated to the appropriate staking platform, bring profit over a sufficiently long period of time.

Of course, the profit varies depending on the staking platform, like Binance or Coinbase and the selected coins.

The staking mechanism supports the blockchain network and confirms transactions.

Obviously, the staking itself takes place most of the time in PoS blockchains.

Finally, the most famous cryptocurrencies for staking are Ethereum, Solana and Cardano.

Advantages of Staking

Staking offers several advantages compared to other cryptocurrency investment strategies.

Firstly, it provides a more stable and predictable source of income, as staking rewards are not solely dependent on volatile market conditions. Secondly, staking contributes to the security and decentralization of the blockchain network.

Lastly, staking allows cryptocurrency holders to actively participate in the network and have a say in its governance.

When Choosing Staking Coins?

When selecting staking coins, it’s important to consider several factors to maximize your potential returns.

These factors include the coin’s market capitalization, staking rewards, utility and use cases, team and development progress, and the overall security and stability of the blockchain network.

Top 17 Staking Coins

Part 1 Staking Coins

At the beginning let’s now dive into the top 17 staking coins, so all finally will be clear.

In fact they offer attractive rewards and promising investment opportunities.

Tezos

Firstly, Tezos is a blockchain platform that enables the creation and execution of smart contracts.

By staking XTZ, users can participate in the governance of the Tezos network and earn staking rewards.

Ethereum

Secondly, Ethereum, the second-largest cryptocurrency by market capitalization, is transitioning from a PoW to a PoS consensus algorithm.

Staking ETH allows users to secure the network and earn staking rewards.

Cardano

Thirdly, Cardano is a blockchain platform that aims to provide a secure and scalable infrastructure for the development of decentralized applications. By staking ADA, users can participate in the network’s governance and earn staking rewards.

Polkadot

Next following project, Polkadot is a multi-chain platform that enables interoperability between different blockchains.

By staking DOT, users can validate transactions, secure the network, and earn staking rewards.

Solana

Then, Solana is a high-performance blockchain platform known for its scalability and low transaction fees.

By staking SOL, users can contribute to the network’s security and earn staking rewards.

Avalanche

After that, Avalanche is a decentralized platform that aims to provide high-speed, scalable, and secure blockchain solutions.

By staking AVAX, users can participate in the consensus process and earn staking rewards.

Cosmos

Indeed, Cosmos is a network of interconnected blockchains that allows for seamless communication and interaction between different blockchain networks.

By staking ATOM, users can contribute to the network’s security and earn staking rewards.

Part 2 Staking Coins

Algorand

Especially, Algorand is a blockchain platform that aims to provide fast and secure transactions with high scalability.

By staking ALGO, users can participate in the consensus process and earn staking rewards.

VeChain

Then, VeChain is a blockchain platform that focuses on supply chain management and product authenticity verification.

By staking VET, users can participate in the network’s governance and earn staking rewards.

Binance Coin

Next one is Binance Coin – the native cryptocurrency of the Binance exchange and is used for various purposes within the Binance ecosystem.

By staking BNB, users can earn staking rewards and access additional benefits on the Binance platform.

Fantom

After Binance Coin, Fantom is a scalable and secure blockchain platform that aims to provide fast and low-cost transactions.

By staking Fantom, users can participate in the consensus process and earn staking rewards.

Harmony

Harmony is a blockchain platform that focuses on scalability and cross-chain compatibility.

By staking ONE, users can participate in the network’s consensus process and earn staking rewards.

Kusama

Kusama is a scalable and interoperable blockchain platform that serves as a testing ground for new features and technologies before they are deployed on the Polkadot network.

By staking KSM, users can participate in the consensus process and earn staking rewards.

Polygon

Polygon, formerly known as Matic Network, is a scaling solution for Ethereum that aims to improve transaction speed and reduce fees.

By staking MATIC, users can participate in the network’s consensus process and earn staking rewards.

Chainlink

Chainlink is a decentralized oracle network that enables smart contracts to securely access external data sources.

By staking LINK, users can participate in the network’s security and earn staking rewards.

Synthetix

Synthetix is a decentralized finance protocol that enables the creation and trading of synthetic assets.

By staking SNX, users can participate in the network’s governance and earn staking rewards.

NEAR Protocol

Finally, NEAR Protocol is a scalable and developer-friendly blockchain platform that aims to enable the creation and deployment of decentralized applications.

By staking NEAR, users can participate in the network’s consensus process and earn staking rewards.

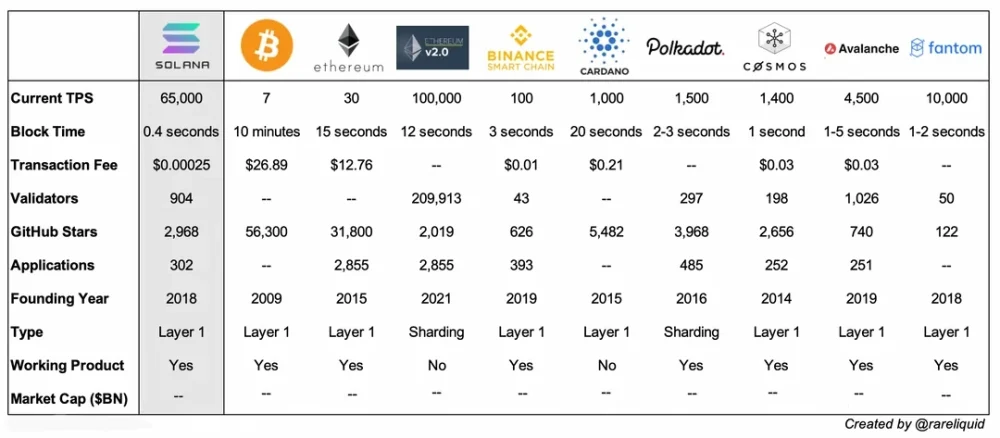

One of the best options you can make is to compare projects in the sector.

In this case, I am writing about coins for staking. One picture explains so much.

The data from this image fully confirms why Ethereum, Solana and Cardano are the most popular staking projects.

Overall, data about the most popular staking projects was downloaded from the irreplaceable Coingecko platform.

How to Stake Your Coins?

To stake your coins, you will need to follow specific instructions provided by each blockchain network.

Generally, the process involves setting up a staking wallet, transferring your coins to the wallet, and initiating the staking process through a designated staking interface.

In general, there are many different ways to stake cryptocurrencies.

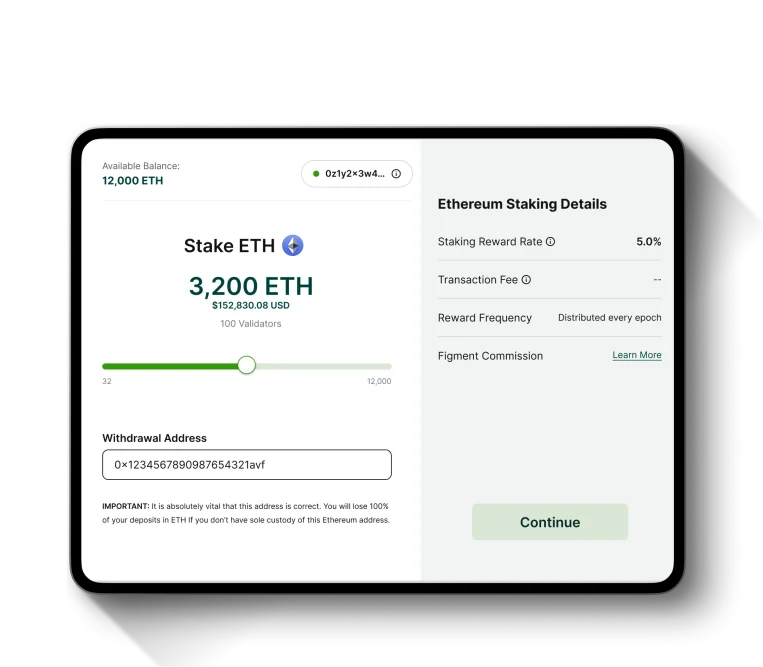

You can use a specially dedicated platform, cryptocurrency exchange or mobile application, but… Figment’s interface is not much different from other interfaces.

The most important thing is ease of use, transparency and access to the most important information.

Well, because you want to know how much you will earn on this investment. Don’t you, in fact?

Staking on Exchanges vs. Self-Staking

While many blockchain networks allow users to stake their coins directly, some users prefer staking through exchanges for convenience. However, it’s important to consider the risks and potential fees associated with staking on exchanges.

But always remember, you may result in a loss of control over your assets and potential centralization of the network.

Risks and Considerations

Before staking your coins, it’s essential to understand the risks involved. These include potential loss of staked coins due to network attacks, smart contract vulnerabilities, and market volatility.

Additionally, consider factors such as the reputation of the blockchain network, but not only.

Take into consideration the team behind the project, and the overall market conditions.

To be honest at all – taking the right staking crypto is the best to do whole fundamental analysis, surely.

Conclusion

Staking cryptocurrencies can be a lucrative way to earn passive income, without a doubt. You can do it while contributing to the security and decentralization of blockchain networks.

By carefully selecting the right staking coins and understanding the associated risks, at first!

Overall, you can maximize your potential returns and actively participate in the growing world of decentralized finance.

Finally, it’s all about being profitable from your own investment.

Those 17 staking coins give you opportunity to do so, but only if you use right strategies to implement it.

Leave a Reply

You must be logged in to post a comment.